How I came second out of 999 in the Salem Center prediction market tournament without knowing anything about prediction markets, and what I learned along the way - Part 2

Last August, the Salem Center at the University of Texas announced a year-long prediction market tournament in partnership with the Center for the Study of Partisanship and Ideology in an attempt to find people who are good at predicting the future. Despite having absolutely no experience with prediction markets, I decided to give it a try and amazingly managed to place second out of nearly a thousand participants.

This post is divided into two parts. The first part begins with a brief description of how the tournament worked, then the overall lessons I learned while participating in the contest. The second part (what you’re reading) is a detailed chronological account of the contest from my perspective, explaining the notable events and how my strategy changed over time.

To avoid hindsight bias and show what I was thinking at the time, this post is largely composed of all the journal entries I wrote about the Salem contest over the last year. Warning, I wrote a lot about the contest during the periods when I was most actively participating, and as a result, this post will be very long.

Quotes from my journal will look like this,

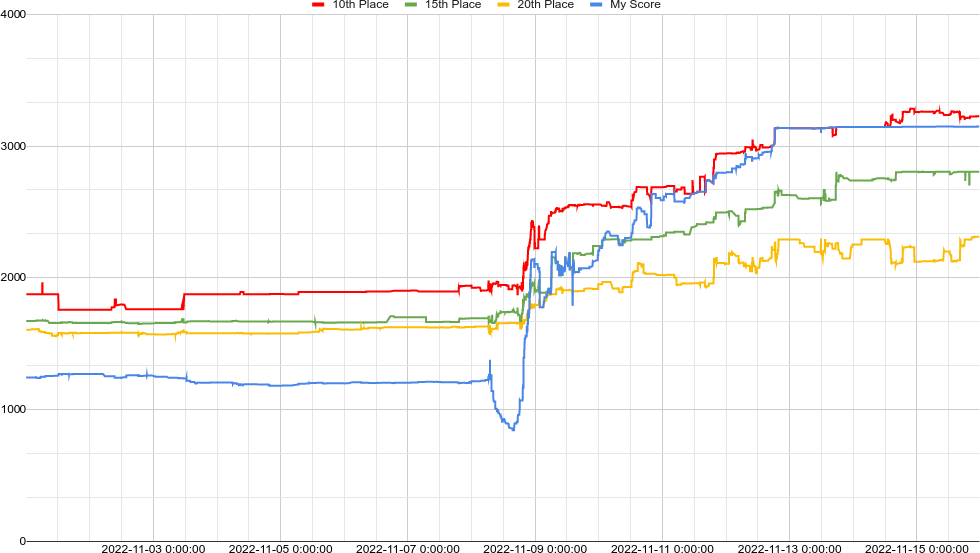

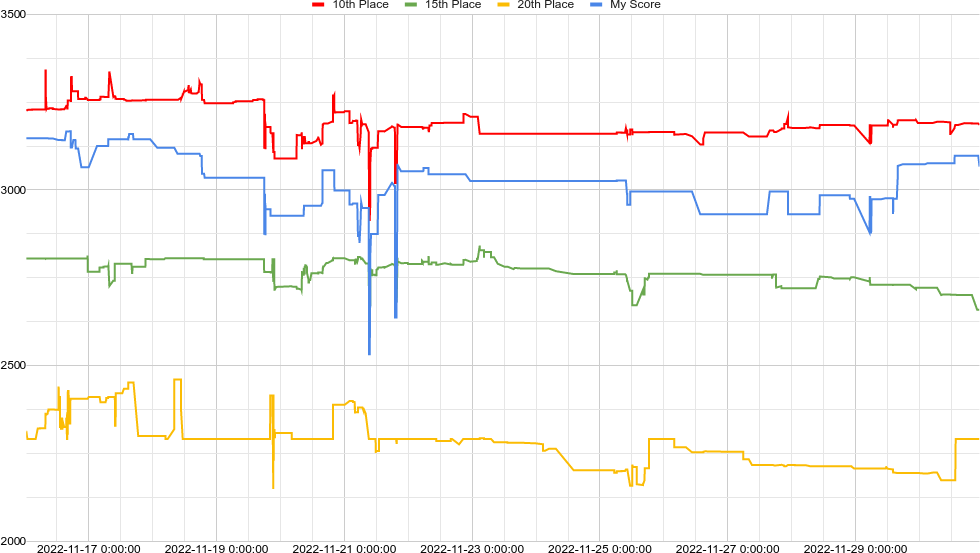

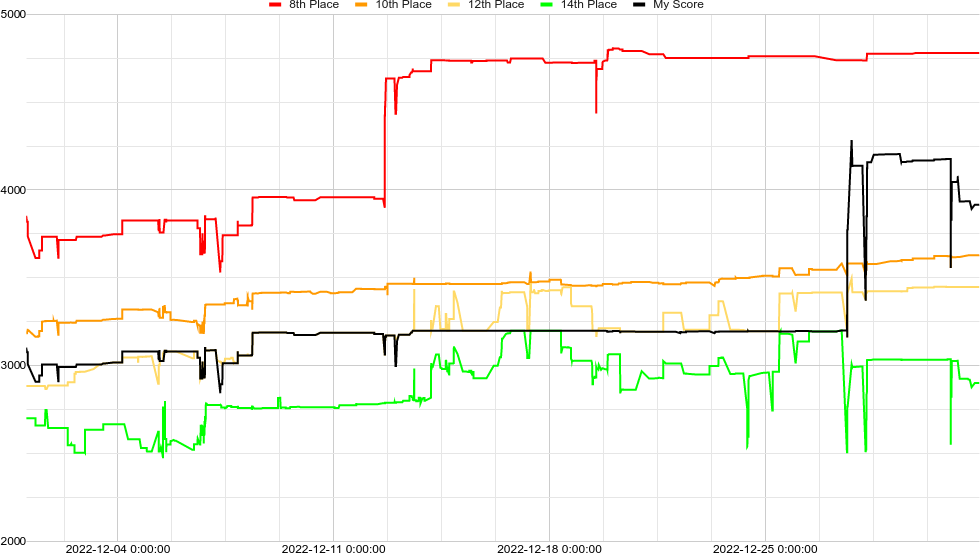

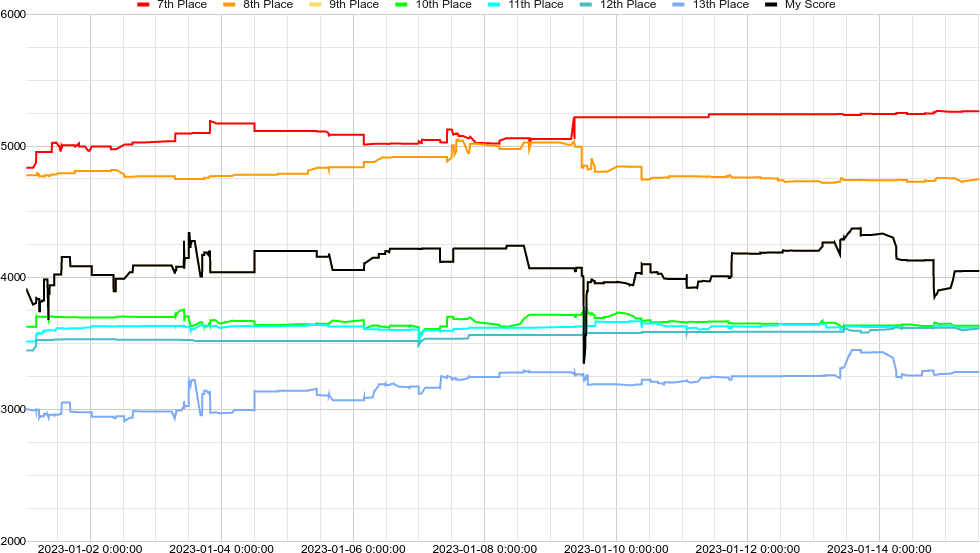

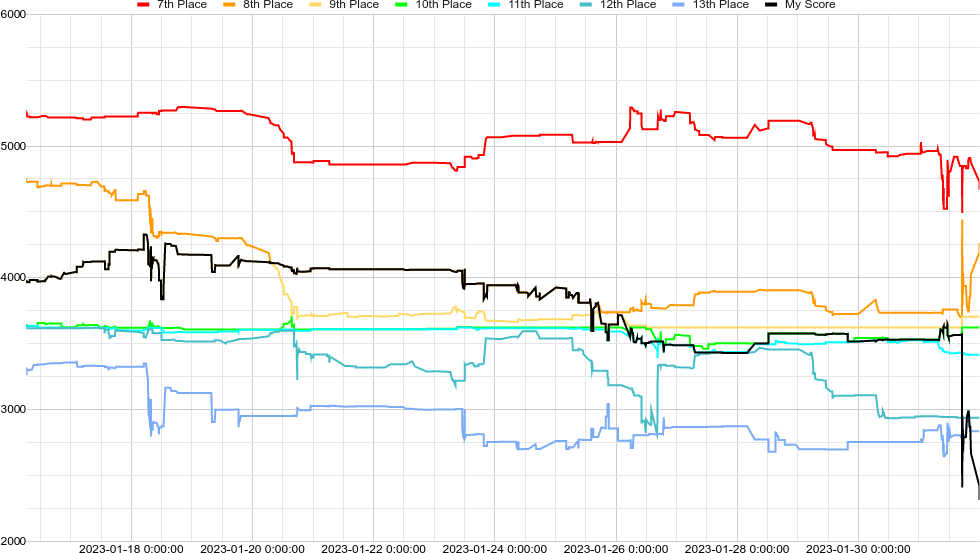

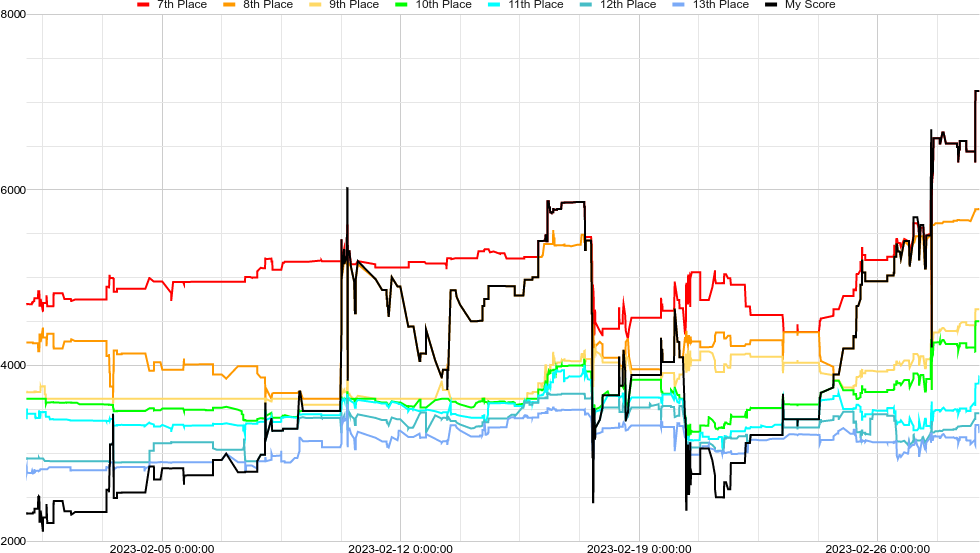

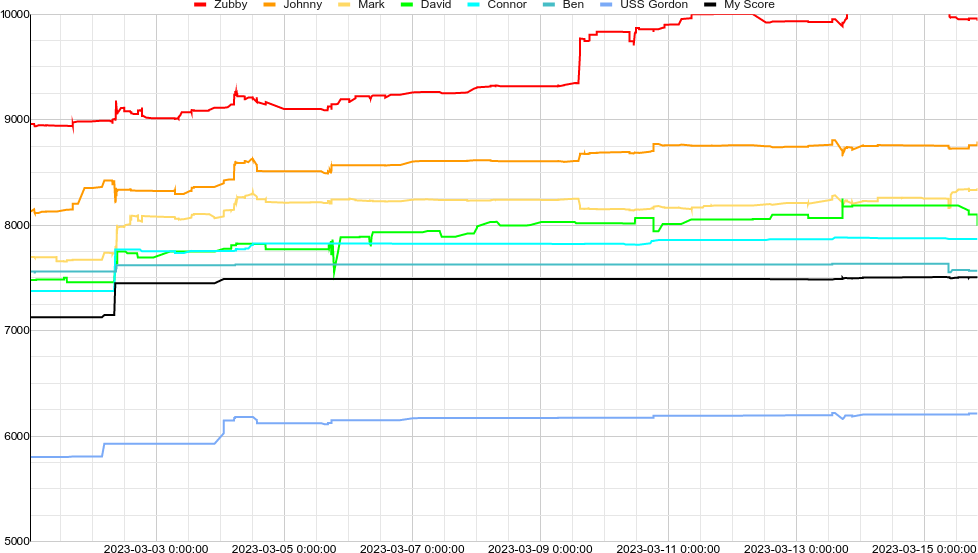

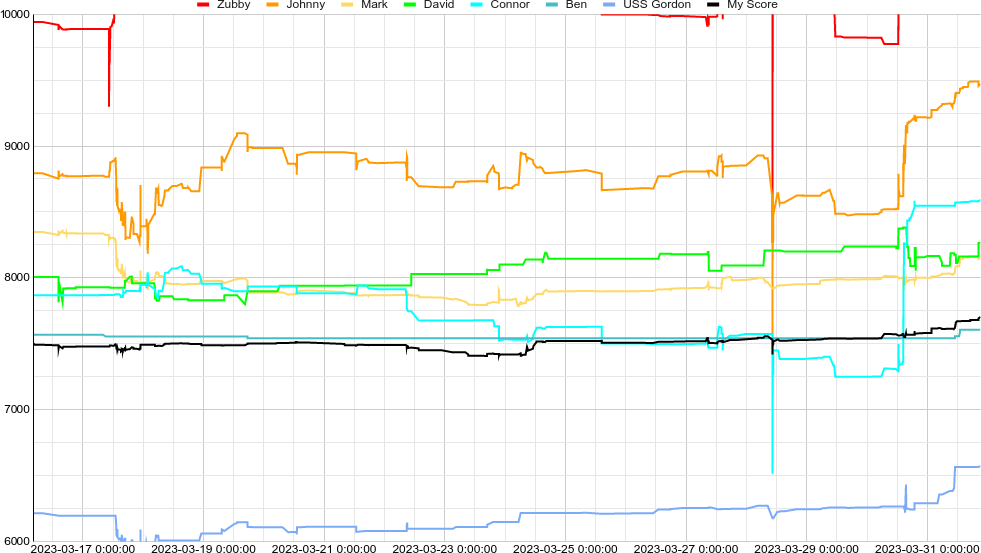

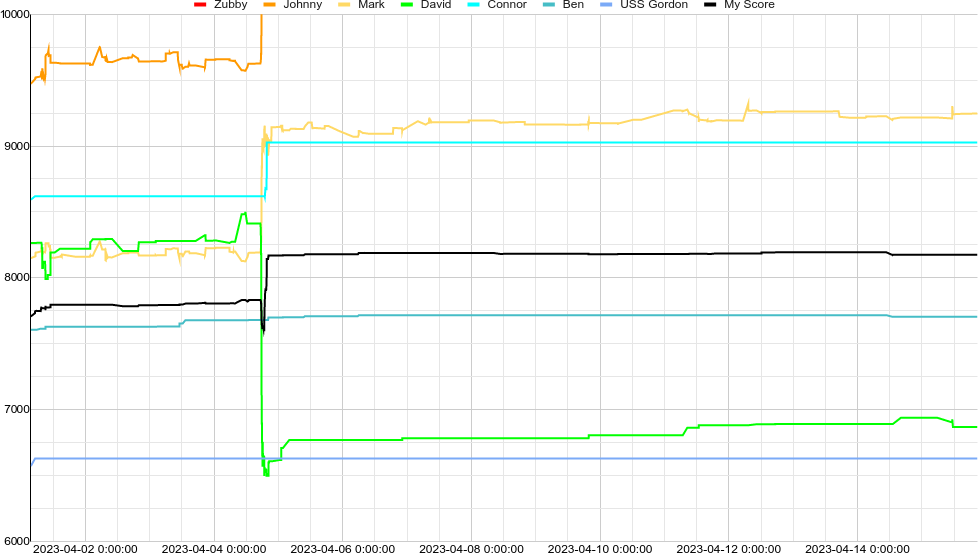

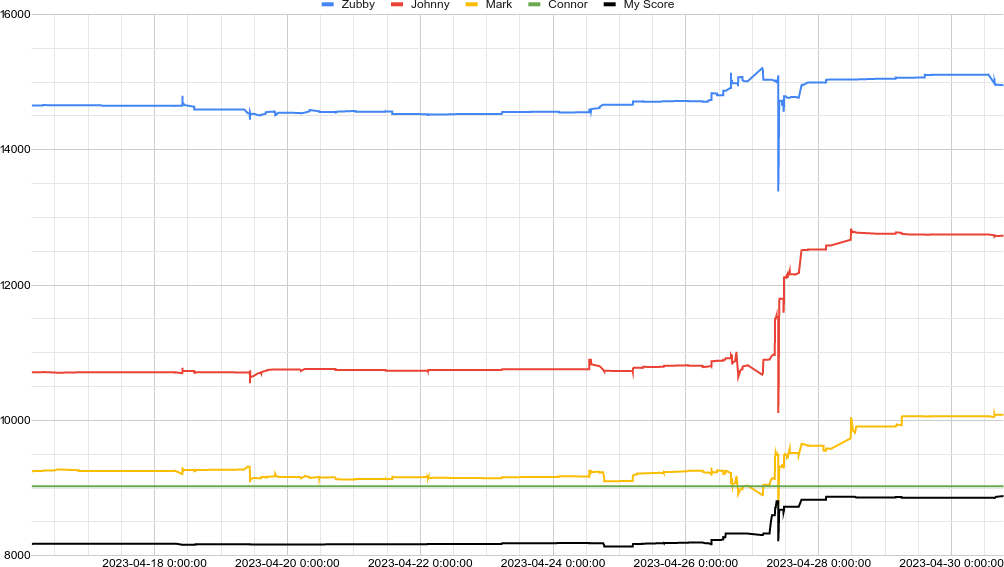

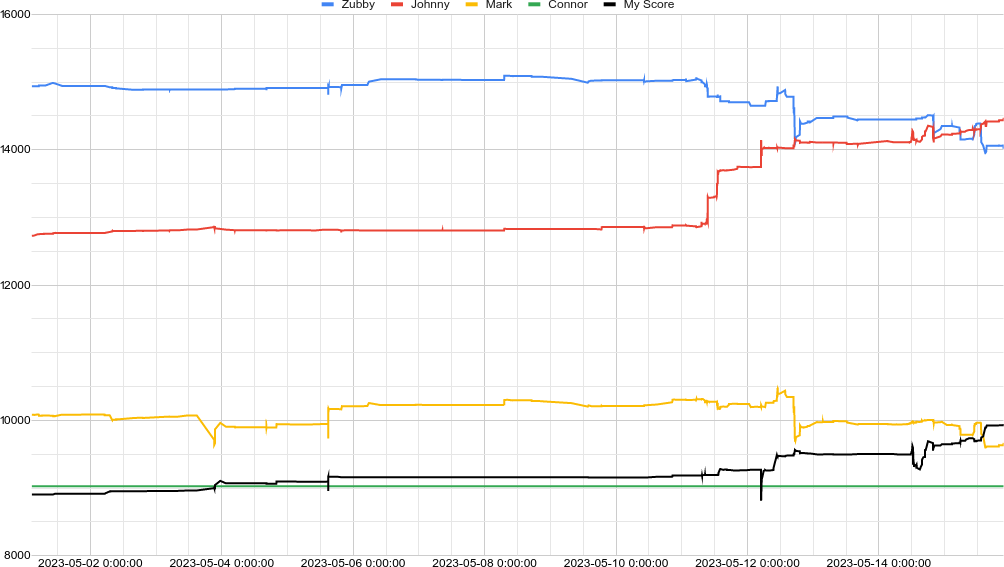

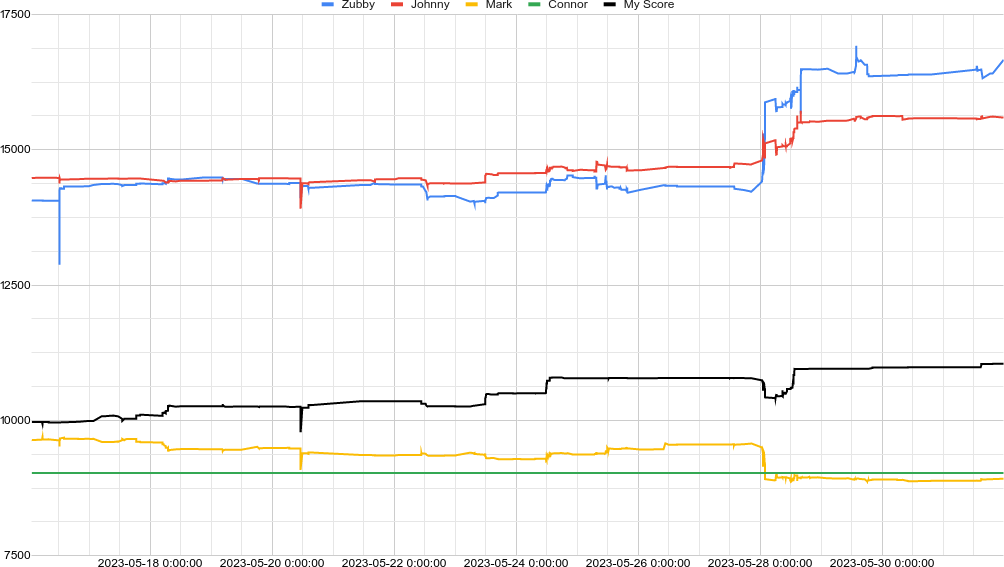

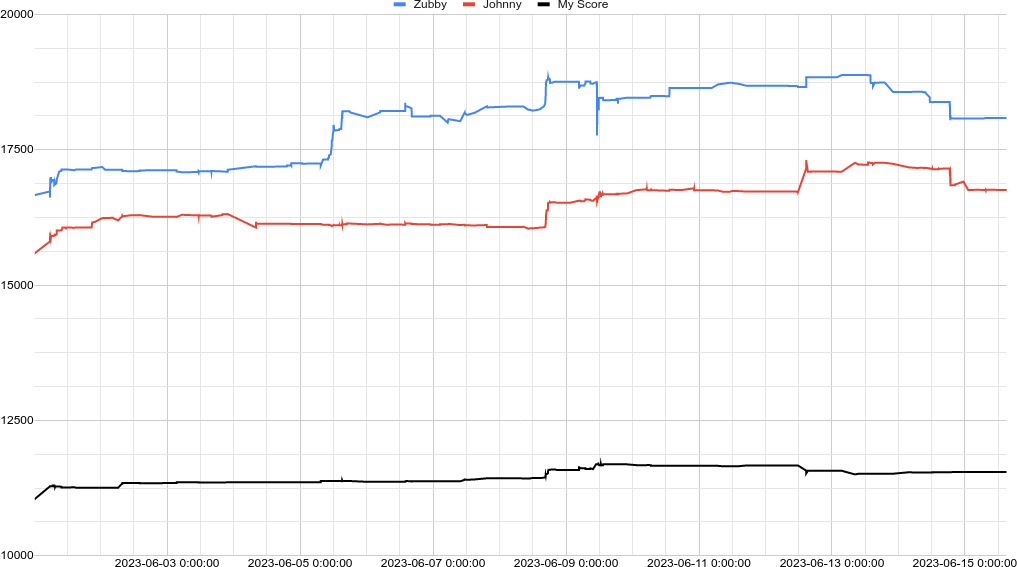

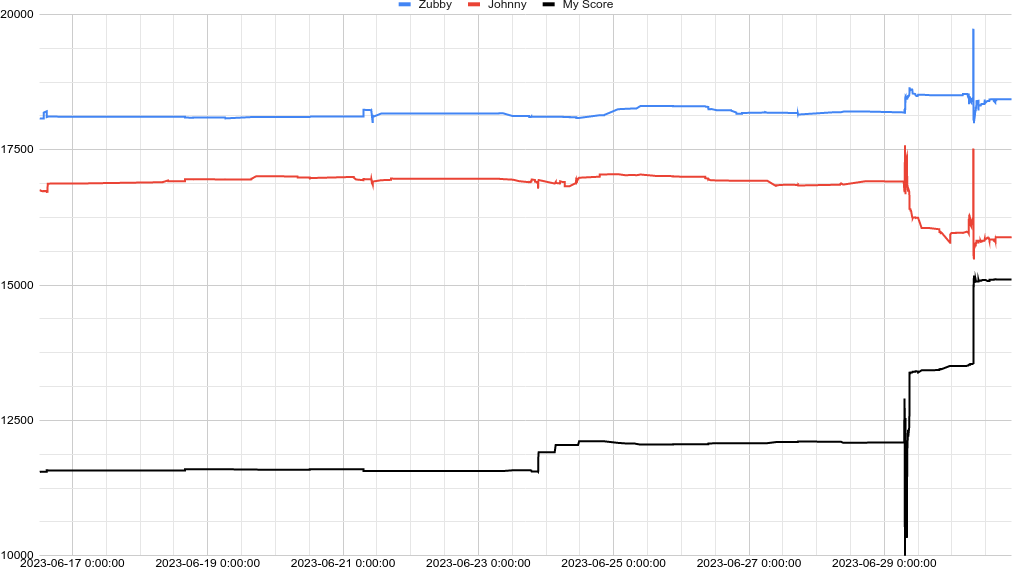

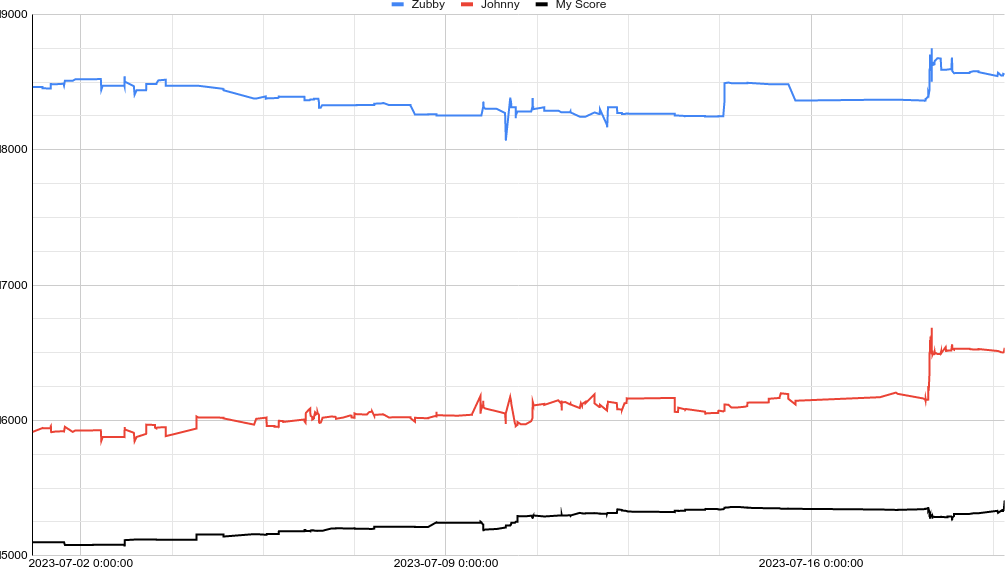

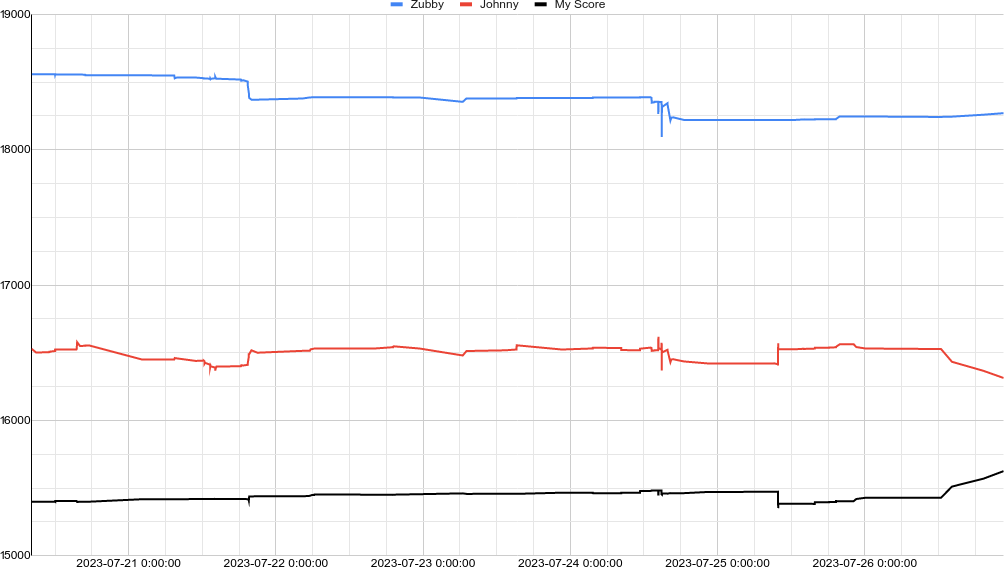

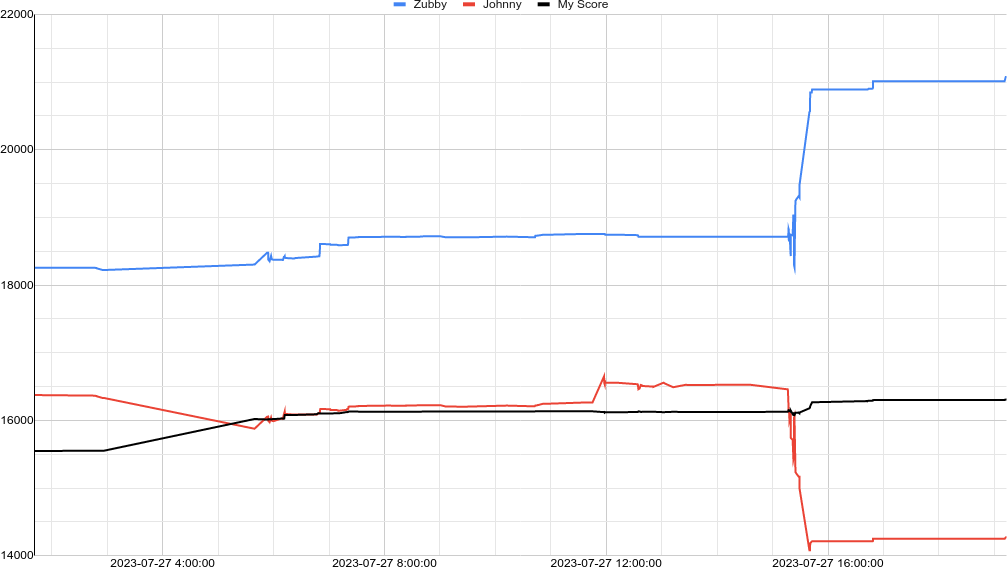

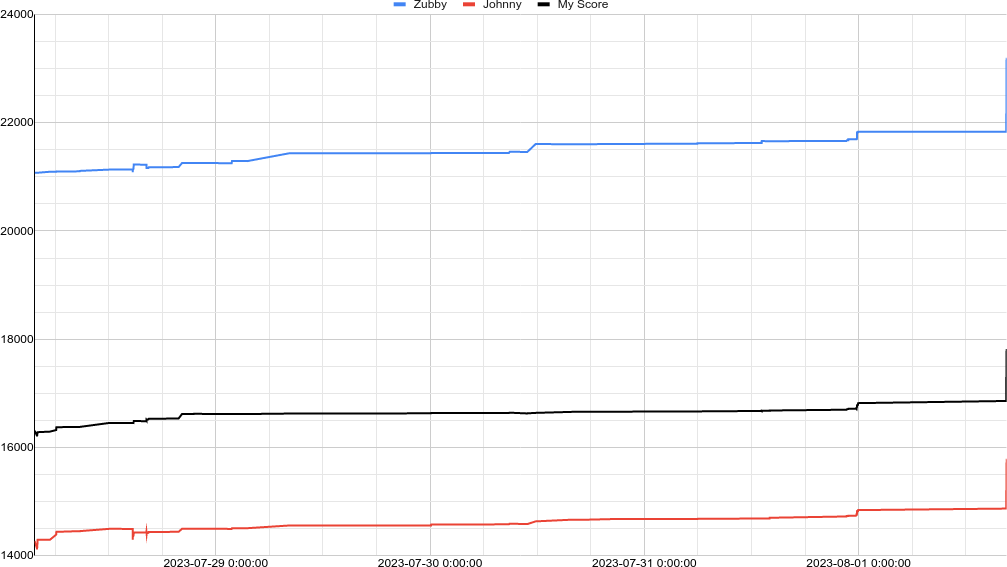

While after-the-fact notes look like this. For the first two and a half months, I didn’t even mention the contest in my journal at all, so I’ve described what happened after the fact like this. I’ve also added graphs for each month (or half month), showing how the positions changed over that period.

August

The contest began on August 7th (first non-Salem Center bet was at 06:02:59), but I didn’t find out about the contest until August 16th, after seeing it mentioned on the blog Astral Codex Ten. At the time, I had absolutely no experience with prediction markets or Manifold, but figured I should give it a try and see if I can win anyway.

When I joined, I assumed that I would discover a clever hack to shoot to the top, or perhaps write a high-frequency trading bot or something, since it seemed unlikely that I’d win playing normally. But for the time-being, I had to make my initial bets.

Initial bets (Aug 16)

The only market I had an obvious edge in was “Will Elon Musk Buy Twitter?”. From months of reading Matt Levine, I was convinced that Musk would be forced to acquire Twitter, but the market was only trading at 45.6%. (And before anyone asks, no I did not buy any real-money Twitter stock.)

However, the contest rules said that you had to “spend at least $50 on each of 20 different markets”. Therefore, I foolishly split the starting $1000 by betting $50 each on 20 different markets, even though I only had a strong contrarian opinion on one. In retrospect, I should have put everything on Twitter, and then if/when I won, I would have had plenty of money to spare and could easily put $50 on 19 other markets later with the winnings, but I didn’t think of that until later.

I didn’t bother trying to find undervalued markets, and ignored the market prices and just bet on whichever outcome I thought was most likely in each market. For the ones I didn’t know anything about, I spent a couple minutes at most researching each market.

However, I did put a little strategy into my choices. Specifically, I chose most of the markets that would be resolving earlier than the Musk Twitter market, reasoning that I could reinvest my winnings into Twitter for additional profit. For the rest, I focused primarily on the markets that would be resolving earliest, though I did bet on a few longer term markets that seemed more interesting.

Here were my initial 20 bets:

2022-08-16 12:12:14 Will Elon Musk Buy Twitter?

$50 for 102.323 YES shares (market price 45.62% -> 46.93%)

2022-08-16 12:13:53 Biden at 40% Approval on Labor Day Weekend?

$50 for 67.950 YES shares (market price 71.21% -> 71.81%)

2022-08-16 12:14:58 Republicans Favored in Senate on Labor Day Weekend?

$50 for 61.737 NO shares (market price 20.87% -> 20.47%)

2022-08-16 12:16:11 US GDP Growth 1% or More in 2022 Q3?

$50 for 137.790 NO shares (market price 66.89% -> 65.25%)

2022-08-16 12:22:38 Will Russia control Kherson on 10/31/22?

$50 for 75.707 YES shares (market price 63.20% -> 64.16%)

2022-08-16 12:23:59 Over 100,000 Monkeypox Cases in 2022?

$50 for 114.178 NO shares (market price 59.60% -> 57.88%)

2022-08-16 12:24:57 Biden Cancels Student Debt in 2022?

$50 for 77.816 NO shares (market price 38.65% -> 37.68%)

2022-08-16 12:26:25 Will Donald Trump Be Indicted for a Crime in 2022?

$50 for 85.407 NO shares (market price 44.52% -> 43.48%)

2022-08-16 12:27:52 Will Russia Control Kramatorsk on 12/31/22?

$50 for 88.098 NO shares (market price 46.39% -> 45.23%)

2022-08-16 12:29:19 COVID Falls Below 20,000 Cases in 2022?

$50 for 244.537 YES shares (market price 17.85% -> 19.82%)

2022-08-16 12:33:38 Will Republicans Win Michigan 3rd District?

$50 for 82.751 NO shares (market price 42.59% -> 41.58%)

2022-08-16 12:34:24 Will Trump Announce in 2022?

$50 for 110.999 NO shares (market price 58.19% -> 56.83%)

2022-08-16 12:35:14 Will Republicans Win the Senate?

$50.0 for 79.949 NO shares (market price 39.68% -> 39.00%)

2022-08-16 12:35:36 Will Republicans Win the Senate in Ohio?

$50 for 62.870 YES shares (market price 77.45% -> 78.12%)

2022-08-16 12:36:44 US GDP Growth over 4% in any Quarter 2022?

$50 for 63.458 NO shares (market price 23.56% -> 22.40%)

2022-08-16 12:37:09 Russia Annex Territory in 2022?

$50 for 100.236 NO shares (market price 53.35% -> 52.08%)

2022-08-16 12:37:41 Will Republicans win the House of Representatives?

$50 for 69.889 YES shares (market price 68.83% -> 69.95%)

2022-08-16 12:38:52 Will Republicans Win the Senate in Arizona?

$50 for 76.913 NO shares (market price 37.83% -> 36.96%)

2022-08-16 12:39:59 Republicans Favored by Summer 2023?

$50.0 for 121.577 NO shares (market price 61.68% -> 60.36%)

2022-08-16 12:40:38 Will Donald Trump Be Indicted for a Crime by July 2023?

$50 for 107.675 NO shares (market price 56.79% -> 55.48%)

The whole process only took 28 minutes, and then there was nothing left to do but wait and hope my genius was rewarded and they all magically came up in my favor.

First blood (Aug 24)

Spoiler: They didn’t. On August 24th, the first market resolved, “Biden Cancels Student Debt in 2022?”. I didn’t expect him to actually cancel student debt, so I lost my first $50 there.

Early chaos

After my initial 20 bets, I didn’t make any more trades on Salem until September. However, I did come across comments talking about the chaos in the first few days of the contest (before I started).

As it turns out, at the start of the contest, the markets had extremely low liquidity, which, combined with a rush of inexperienced players who didn’t understand the inner workings of Manifold, led to chaos as people would come in and bet large amounts on a market and the market price would swing it up to 99% or below 1% due to the lack of liquidity.

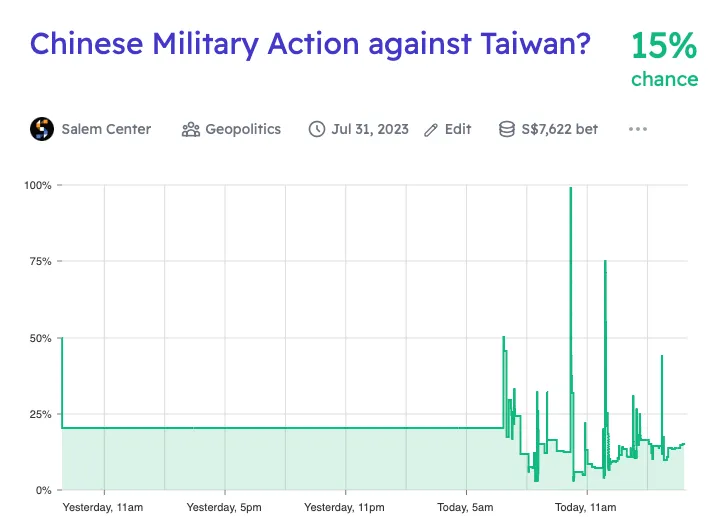

Here you can see that the “Chinese Military Action against Taiwan?” market swung up to 99.0% on the second day of the contest. The only reason it stopped at 99.0% is because one savvy player had put a limit order at 99.0% in order to profit from just such a mistake. This led to massive profits for the few players who were able to exploit the wild price swings of the first few days.

As a result Salem did two things. First, they increased the liquidity pool for each market from $100 to $2000. Roughly speaking, this means that any given trade would move the market by 1/20th as much as before.

Additionally, they announced that they would subtract out first-day gains from player’s scores for the purposes of rankings on the leaderboard. Players who managed to “unfairly” profit from the early chaos would still have an advantage, because they would have a lot more money to invest, making it much easier to gain more money in the future. However, the fixed score adjustment would at least give players who weren’t there early and didn’t luck out a fighting chance.

This all happened before I even heard about the contest, and I was a bit disheartened when I found out about it, since it seemed like I had missed my chance and the contest would be decided by who was in the right place at the right time in the first few days.

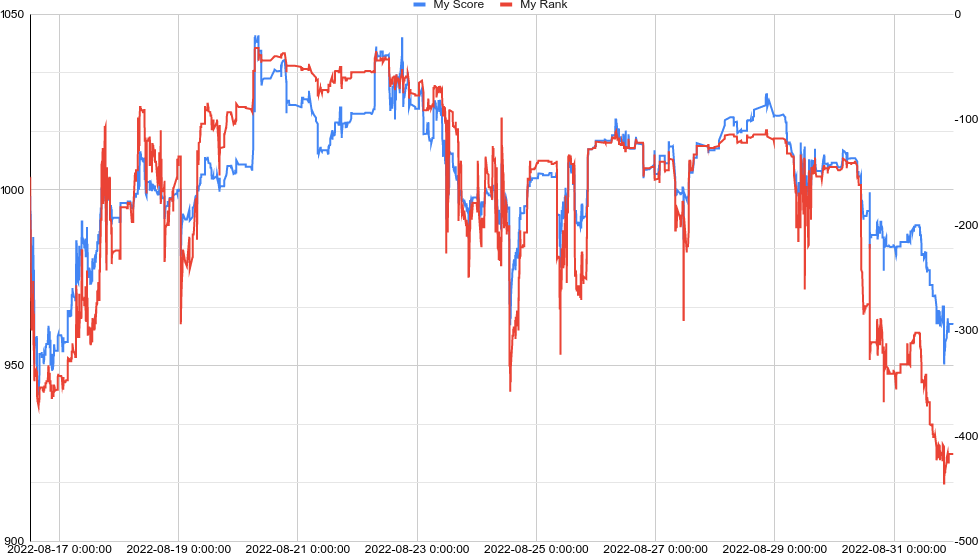

August standings

Here’s a graph of my score and rank over the course of August. My score varied from a low of 941.9 to a high of 1044.0 and is plotted on the left axis, while my rank varied from 32nd to 445th and is plotted on the right axis.

Since I didn’t actually make any bets in August after I started, all this variation is due to market movement over time changing my “portfolio value” at market prices. You can, however, see a big dip on August 24th, when I lost on the student debt cancellation market.

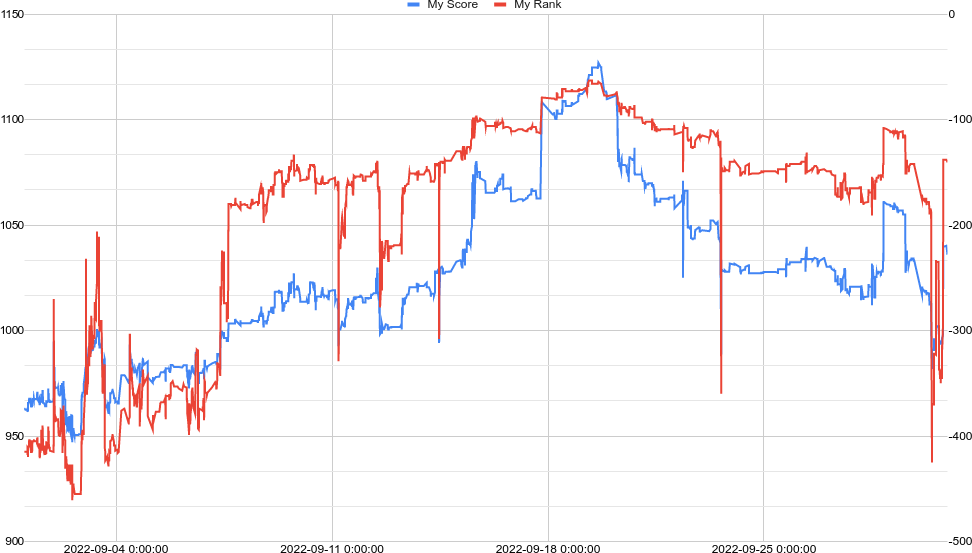

September

September was quiet, and went pretty much the same as August, with my balance jumping around randomly due to market movements.

The one notable event came on September 2nd, when the next two markets resolved in my favor (“Republicans Favored in Senate on Labor Day Weekend?” and “Biden at 40% Approval on Labor Day Weekend?”), and I duly reinvested the winnings in the Twitter Acquisition market.

2022-09-02 21:21:58 Will Elon Musk Buy Twitter?

$129 for 307.863 YES shares (market price 37.66% -> 41.28%)

Conveniently, the market price was now down to 37.66%, even lower than my initial purchase in mid-August.

There was actually a third market that also resolved on September 2nd, “Over 400,000 Jobs in August?”, but I didn’t know that at the time, since I never bet on that market and hence didn’t get an email about the resolution.

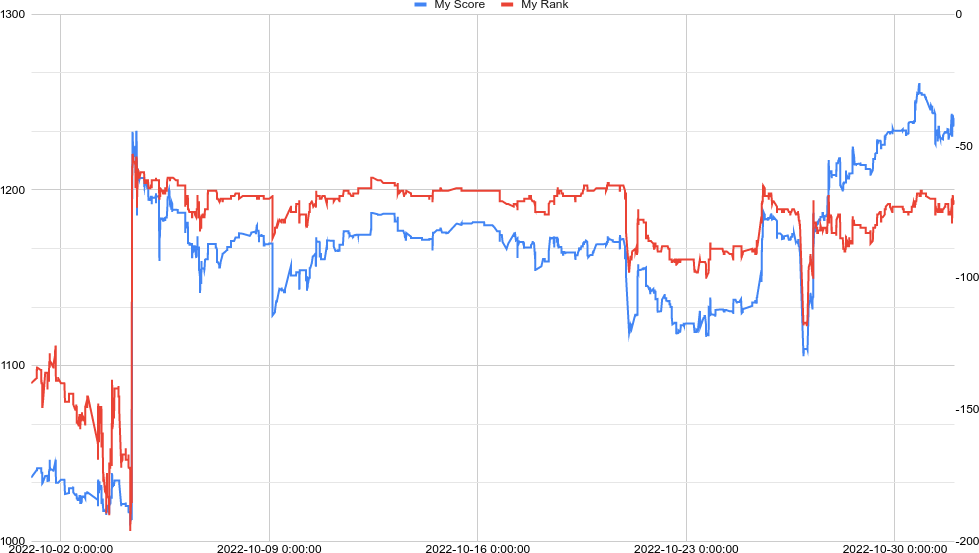

October

October began with another bit of bad news when “Russia Annex Territory in 2022?” resolved YES on October 3rd. I couldn’t believe that Putin would formally annex more of Ukraine, and thus lost my $50 there.

I didn’t know it at the time, due to only checking Salem when I got a market resolution email, but there was a huge jump in my score and rank the next morning on October 4th as the Twitter Acquisition market suddenly went from 48.1% to 84.6%.

October 27th

The next two market resolutions came on October 27th. (Or rather, the next two resolutions for me. “Fewer than 300,000 Jobs Any Month in 2022?” resolved on October 6th, but I wasn’t in that market.)

The first, “US GDP Growth 1% or More in 2022 Q3?” went against me, as at the time I was pessimistic about the economy and bet NO. Then came the important market, “Will Elon Musk Buy Twitter?”, where I made my first big profit.

I wasn’t sure what to do next, so for the time being, I just reinvested all my money in “Will Russia control Kherson on 10/31/22?”. I noticed that it was still only at 89%, despite the fact that it would be resolving in just 3-4 days, and after the months of slow progress in Kherson, I couldn’t imagine anything changing overnight, so it seemed like safe, easy money to me.

2022-10-27 18:25:49 Will Russia control Kherson on 10/31/22?

$410 for 453.868 YES shares (market price 88.86% -> 89.97%)

This was the first of several markets I invested in which seemed like safe short term bets to earn a little bit of extra money, which I thought of almost like an “interest rate”.

November 1-15

The first two and a half months of the contest were very quiet for me, but everything changed in early November.

Initial plans

By late October, I had grown alarmed at how much time and thought I was devoting to the Salem contest when I was unlikely to actually have any chance of winning. At the time, I had no idea what my rank was or how far away the top players were, but I assumed they were significantly higher, and thus that I’d have to double my money to even have a shot at the leaderboard.

Therefore, I came up with a plan. I would bet everything on Democrats in the midterms, and either lose everything, in which case I would stop participating in the contest and stop wasting my time, or else win big and thus hopefully be a serious contender in the contest.

However, for the time being, I invested my free money in one last “risk-free” market for a quick 10% return, “Biden at 40% Approval on Election Day?”, which would conveniently be resolving the morning of election day, just in time for me to bet on the midterms.

2022-10-31 22:18:12 Biden at 40% Approval on Election Day?

$530 for 587.881 YES shares (market price 88.49% -> 89.96%)

Election day (November 8th)

At 06:53 on November 8th (morning of Election Day), right before I made my election bets, my score (portfolio value at market prices) was up to $1252.69, a 25% gain over the starting $1000. I didn’t know it at the time, but I was in 74th place, with 1st place at $5554 and 20th place at $1603.

The final “deluxe” forecast from 538 gave Republicans a 59% chance to win the Senate. (It later turned out that there was a minor data error with the Deluxe model, and it would have given Republicans 55% using the correct data, but noone knew that at the time.)

However, prediction markets were much more bullish on Republicans than 538, and Salem was no exception, with Republicans at 73.4% to win the Senate at the time. I had heard that prediction markets long had a noticeable pro-Republican bias, as most vividly demonstrated by the fact that they gave Trump a significant chance of winning in 2020 even after Biden had been sworn in as president.

I’d read Richard Hanania’s The Problem with Polling Might Be Unfixable, which argued that polls might have a systematic pro-Democrat bias that is impossible to correct for. It seemed plausible, given that Trump outperformed the polls in 2016 and 2020, and even in 2018, when the polls were spot-on overall, Democrats lost a lot of close Senate races. I didn’t think that that conclusion could really be drawn from just two data points, when there is so much noise and when pollsters are constantly adjusting their methods to attempt to correct for identified bias. But the argument seemed plausible, and I figured if it happened a third time, it would be looking pretty good.

On the other hand, there were also reasons to think that 538 might be underestimating the Democrats’ chances. I’d been following Paul Krugman on Twitter, who argued that Biden’s approval ratings had been closely tracking gas prices up and down.

With gas prices falling in late October, a continuation of this trend would presumably lead to a steady increase in Democratic support, and since polls are a lagging indicator, that would imply that the polls were slightly underestimating Democrats. (As it turns out, it appears that gas prices ticked up slightly in the week before the election). But overall, I didn’t really know much, and figured that 538’s estimate was the best predictor, or perhaps slightly more to account for the chance of Hanania being right.

As it turns out, I was actually right about the prediction markets being heavily biased towards Republicans, but it’s not like I can really pretend to have called this. After all, if you think something has a 60% chance of happening and the market price is at 73%, that’s still normally not a reason to go all in on NO. And I did go to bed thinking Republicans were more likely to win than not.

The real main reason I went all in on Democrats is that I already had some small bets on them, and so it made sense to double down. (And of course, the odds were much better as well - there wasn’t much money to be made betting on Republicans anyway!)

Back in mid-August when I started the contest, things were looking good for the Democrats, and thus when I placed my initial $50 bets, I bet on Democrats in nearly every midterm contest (I did still have Republicans to take the House of Representatives and the Ohio Senate seat.) By late October, the polls had reversed, and if I had started in October rather than August, I probably would have bet on the Republicans instead. But fortunately, that didn’t happen.

Anyway, I sold all my initial $50 bets that weren’t already invested in the various midterm markets, and combined with the winnings from Twitter and the Kherson/Approval “interest”, I had $997 in free cash to invest.

I decided to split my big bet between two markets in an attempt to reduce slippage, and chose “Will Republicans Win the Senate?” and “Will Republicans Win the Senate in Nevada?”, since based on the coverage I’d read, I thought that Nevada was the individual race where Democrats had the best chances. (I was particularly worried about Fetterman’s chances, which turned out to be the opposite of correct.)

At the time, I had no idea how the liquidity or market making worked. I didn’t know anything about Manifold’s automated market making algorithm, and assumed that the markets just functioned based on crossing orders with people betting the other way somehow. I guessed that liquidity would be roughly proportional to the “total amount bet” display and initially tried to split the bets proportionately, but then gave up on that and split the money roughly equally, $522 on the Senate and $475 on Nevada.

2022-11-08 06:53:48 Will Donald Trump Be Indicted for a Crime by July 2023?

$-40.1908112464 for -107.675 NO shares (market price 59.59% -> 60.85%)

2022-11-08 06:54:02 Republicans Favored by Summer 2023?

$-46.261929156 for -121.577 NO shares (market price 58.69% -> 60.29%)

2022-11-08 06:54:10 US GDP Growth over 4% in any Quarter 2022?

$-53.8043951876 for -63.458 NO shares (market price 13.66% -> 14.16%)

2022-11-08 06:55:04 COVID Falls Below 20,000 Cases in 2022?

$-29.8252755891 for -244.537 YES shares (market price 13.90% -> 12.76%)

2022-11-08 06:55:18 Will Russia Control Kramatorsk on 12/31/22?

$-65.4022055518 for -88.098 NO shares (market price 23.49% -> 24.13%)

2022-11-08 06:55:28 Will Donald Trump Be Indicted for a Crime in 2022?

$-55.1746640661 for -85.407 NO shares (market price 32.60% -> 33.49%)

2022-11-08 06:55:38 Over 100,000 Monkeypox Cases in 2022?

$-101.981483177 for -114.178 NO shares (market price 9.60% -> 9.84%)

2022-11-08 06:56:17 Will Trump Announce in 2022?

$-16.7367339772 for -110.999 NO shares (market price 83.28% -> 83.82%)

2022-11-08 06:59:15 Will Republicans Win the Senate?

$522.0 for 1477.001 NO shares (market price 73.41% -> 59.55%)

2022-11-08 07:00:11 Will Republicans Win the Senate in Nevada?

$475 for 1261.301 NO shares (market price 70.93% -> 57.39%)

Despite splitting my bet between two markets, they still moved the markets significantly (73->60% and 71->57%), and people quickly pushed the market price back up, so I could have gotten a lot better prices if I had split my bets up into multiple purchases and waited for the market price to bounce back in between. But of course I didn’t know that at the time, and wasn’t trying to put much effort into something I didn’t expect to pay off anyway.

… and then it was time to wait and forget about Salem and isolate myself from the news.

Election night

As usual, I completely avoided the news on election night and didn’t check the results until the following morning in order to minimize pointless stress. I also mentioned the Salem contest in my journal for the very first time:

08.11.22

22:15 - …I deliberately avoided the news this evening. I’m planning to check during the day tomorrow to avoid pointless angsting, since it’s not like we can do anything about it anyway other than just wait. I do know that Republicans won the senate in Ohio because the Salem Contest Manifold markets thing sent me an email about the market resolution, so that rules out a massive blue wave, but that’s it.

Note: The first market to resolve that night was actually “Democratic Governor in Texas or Florida?”, but I didn’t bet on that one and hence didn’t get an email for it. Besides the Ohio Senate, the only other resolution email I got was “Will Republicans Win Michigan 3rd District?”, which resolved NO at 3:30am that night.

I didn’t know this at the time, but the first couple hours of results on election night were apparently favorable for Republicans, so it’s a really good thing I wasn’t following the results live. The Salem markets naturally swung R during this time, causing my score to reach a low of 843.6 and briefly sent me all the way down to 681st place, my lowest rank during the entire competition.

November 9th

09.11.22

08:08 - … I also got another email from Salem saying that Republicans did not win the Michigan 3rd district.

09:19 - … Anyway, with all the layoff drama, I figured I might as well go ahead and check in on the election results as well. Looks like things are very close, though Republicans still have a slight edge. But even the fact that it is close is a really good night for the Democrats. It was about the best that could be expected, given how dire things had been looking for the last month.

When I finally checked in on Salem on Wednesday (the 9th), I kicked myself for not betting on Fetterman, as that market had already resolved overnight. But of course, there was no way to know that in advance.

The next mention of Salem in my journal wasn’t until the 12th, when I finally got around to describing it in detail and recounted pretty much the same history described here, as well as the post-election night bets:

12.11.22

08:20 - … Anyway, I should explain the Salem Center thing now. In early August, the Salem Center at the University of Texas launched a prediction market contest on Manifold. Everyone starts with $1000 of virtual money and can bet on various prediction markets. They’re looking for a new research fellow and said they would choose between the top 5 finishers of the contest.

I found out about the contest on ACX and decided to give it a try just for fun. I don’t know much about prediction markets and didn’t plan to put much effort into it, but I figured I might as well try and maybe I’d manage to get into the top five anyway. Obviously, I don’t actually want the job, but I thought it would be cool if I won just for bragging rights.

The original rules required you to spend at least $50 on 20 different markets in an attempt to prevent people from just getting lucky on one or two bets. Of course, they quickly changed the rules to be a lot more subjective, saying they would carefully consider everyone’s patterns of betting, etc. to avoid abuse of the system or people just getting lucky.

Anyway, the only market I was really confident on that the market was seriously undervaluing was Musk to acquire Twitter, but I foolishly decided to just split the starting $1000 equally between 20 markets, just randomly betting on whichever side seemed most likely to me in each case, and planning to reinvest the proceeds of early resolving markets back into Twitter. In retrospect, I realized that I should have just put everything into Twitter, and then once I’d massively increased my bank roll, throwing 20 into 19 other markets would be a lot less onerous. Oh well.

As it turns out, of the five markets to resolve pre-Twitter, I only won two (Biden approval 40+% on Labor Day - YES and Republicans favored in Senate on 538 on Labor Day - NO) and lost three (Biden Cancels Student Debt in 2022? - NO, US GDP Growth 1% or More in 2022 Q3? - NO, and Russia Annex Territory in 2022? - NO). So I was able to double down on Twitter, but not that much.

After Twitter resolved, I reinvested into short term high probability bets to eke out a few extra bucks (first Will Russia control Kherson on 10/31/22? - YES, then Biden at 40% Approval on Election Day? - YES).

When it resolved on Election Day morning, my “portfolio value” was up to around 1250-1280, but figured I had no chance of winning like that and that I might as well gamble everything on a risky bet, since I wasn’t going to win anyway otherwise. Therefore, I sold all my non-election related bets and split everything between NO on Will Republicans Win the Senate? and Will Republicans Win the Senate in Nevada?.

I remember that I bought the latter from 71% down to 60%, but it almost immediately started going back up again (lots of people betting on election morning). All of the Salem markets were significantly more pro-R than even 538’s last forecast. I know other prediction markets were also more R leaning than 538, especially PredictIt, but PI has a notorious pro-R bias. At least it further increased the margins on my bets.

As mentioned, two of my original bets (Will Republicans Win the Senate in Ohio? - YES and Will Republicans Win Michigan 3rd District? - NO) resolved on election night, but then nothing until Thursday night. Wednesday evening, I finally checked in on Salem again for the first time in a day and a half and saw that I was up to 2075, and in 15th place on the leaderboard.

I was shocked, since I didn’t think that even doubling my money would be enough to get onto the leaderboard. Of course, I’m probably much farther from the top 5. In order to discourage people from gambling everything on risky bets to improve their ranking, the leaderboard does not actually show anyone’s value, just the names and ranking, and just for the top 20.

I was tempted to sell to lock in my gains, but balked at the massive slippage it would entail, which is just as well. Instead, I just plowed the winnings from Michigan and Ohio into another sure-win market (Michigan Abortion Rights Landslide? (60+% of the vote) - NO) that hadn’t resolved yet for some reason (7% at the time) to earn a few extra bucks.

After I got back from Safeway last night, I saw the first resolution since election night, (Will Republicans Win the Senate in Arizona?) and put the money into another sure-win, (Another Polling Miss in the Midwest and Pennsylvania?, aka 3+% pro-R average polling miss in midwest + PA), which was down to 4%, just like the Michigan abortion market.

Anyway, the Michigan abortion and polling miss markets finally closed this morning, and there weren’t any sure-wins left, so I put the money into Nevada Senate (buying it from 10% down to 9%), as I realized that if I lose my big bets, I’m toast anyway, so I might as well double down. My portfolio value is currently up to $2916, and I’m now 12th on the leaderboard.

2022-11-09 19:24:53 Michigan Abortion Rights Landslide?

$146 for 156.282 NO shares (market price 7.38% -> 7.11%)

2022-11-11 20:31:14 Another Polling Miss in the Midwest and Pennsylvania?

$77 for 80.017 NO shares (market price 4.20% -> 4.14%)

2022-11-12 07:48:27 Will Republicans Win the Senate in Nevada?

$236 for 259.092 NO shares (market price 10.14% -> 9.41%)

12.11.22

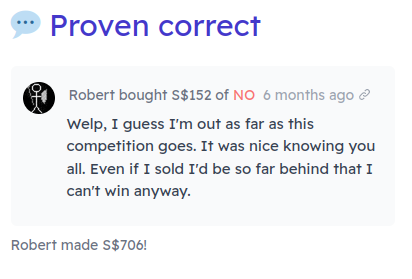

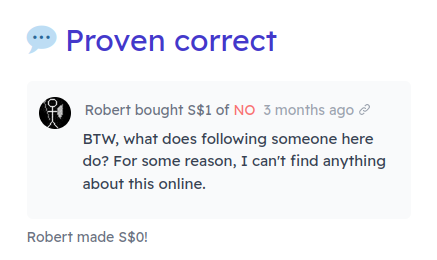

18:34 - My big bets on Salem just resolved, leaving only one small bet (R to take house, ironically enough). Each market shows the top 5 bettors in total profit as well as a “proven correct” and “smartest money” listing with unclear methodology. I got “smartest money” in both.

For Republicans to take Senate overall, it says “Robert Grosse bought S$522 of NO from 73% to 60% 4 days ago Robert Grosse made S$955!”, but then I’m listed in 4th under Top Bettors with a total profit of only $984 (first was John Gross-Whitaker with 1271). Presumably the discrepancy is because I also put $50 in back in August, which had gone down in value as the Rs rose in the polls. The “smartest money” section must be showing my total profit since the big bet on election day, including the re-appreciation of the original 50, while the top bettors must be counting total money won from when the bet was placed, rather than Tuesday.

Note: Smartest Money actually just shows the profit for the one specific bet that was chosen, so the initial $50 had nothing to do with it. And 955 < 984 anyway. I’m not sure why I thought otherwise.

On the Nevada Senate market, the smartest money said “Robert Grosse bought S$475 of NO from 71% to 57% 4 days ago Robert Grosse made S$786!” (which incidentally shows that I didn’t quite remember the odds at time of my purchase correctly). Meanwhile I’m 2nd under Top Bettors with total profit $809 (First is David Hassett at 1566). Presumably this time, the total profit is higher because the smartest money isn’t counting the extra bit I put in last night? It’s interesting to try to reverse engineer what it is saying like that.

Anyway, I’m now at 3134 portfolio value (3077 cash) and up to 10th in the rankings. John Gross-Whitaker is at 15th while David Hassett is up at 6th, which makes sense given his massive winnings in Nevada. Anyway, I’m planning to just leave things be for a while while I decide what to do next, since I actually have a good shot and there aren’t any easy wins left now that the elections are over.

November 13th

I didn’t notice this at the time, but I was briefly up to 9th place from 16:13 to 17:35 on the 13th. However, I ended the first half of the month in 11th place.

November 16-30

With Election Week almost over, the second half of November was much quieter than the first half. (There were around three times as many bets in the first half of the month as in the second.) However, there were still a few notable events, and one major lesson I learned the hard way.

16.11.22

08:12 - P.S. Yesterday evening, I got another resolution email from Salem, for “Will Trump Announce in 2022?”. Which is odd, since I of course sold everything. It claimed my investment was 33 and my payout 0. In reality, I put in 50 at the start and sold for 18 on election day, so presumably a bug causes it to think the difference was still invested for the purpose of the email sending. I guess this means I’m going to be getting resolution emails for every market I’ve ever participated in as well. Or at least the ones where I sold for a loss.

Note: I’m still a bit baffled by this one. I assume that a rounding bug resulted in me still having an infinitesimal fraction of a share, and so it mistakenly thought I was still invested in the market and thus the email still triggered. But if so, it somehow didn’t even show up in the API, because the logs show that I bought and sold exactly 110.998594394 shares each time.

Perhaps it really does just email everyone on resolution if you’ve ever invested in the market, even if you later sold everything. I don’t think I ever fully sold out of a market again without buying back in like this anyway, so I wouldn’t know.

08:55 - I decided to go ahead and throw all my money into the “Republicans to take House” market in Salem. Of course, lots of other people already had the same idea, and I purchased it from 99.3 to 99.4%, with a profit of 18 off of 3077 if I win. It looks like it shows 0.1% increments once it goes above 98%, something I’d never seen before. The 3rd place, Connor Pitts, put over 6k into it last night, and I’m sure the others have large amounts as well. I’m also down to 11th in the rankings. Oh well.

2022-11-16 16:43:49 Gay Marriage Bill in 2022?

$3166.0 for 3198.238 YES shares (market price 98.69% -> 99.00%)

The gay marriage fiasco

As mentioned, I had earned “interest” in late October by betting on near-certain markets that would be resolving shortly, and continued doing so with a succession of unresolved markets on Election Week following the midterms. Naturally once the House market finally resolved, there was the question of what to do next with my money. In the afternoon, I noticed that “Gay Marriage Bill in 2022?” had spiked and decided to pile in. Unfortunately, this turned out to be a huge mistake, as described in the previous post.

22:28 - Late this afternoon, I checked in on Manifold again, since the House had finally been called earlier. I noticed a market, “Gay marriage bill in 2022” which had suddenly shot up and was at 98.7%, usually a sign of a near-sure win, so after reading a news article for confirmation, I threw everything in. As usual, Connor Pitts was there 35 minutes before me with his 6.5k stack. I’m also down to 12th place now.

Of course, now that I’m in the big leagues, the people ahead of me are all the ones who actually know what they are doing and are willing to spend time obsessively checking the news to quickly pounce on easy wins (and have much larger bankrolls besides). My plan was (and is) to wait until this weekend and figure out the state of things and decide what to do going forward. I figured that with all the election stuff out of the way, things would be pretty static, so it’s disappointing that I’ve already dropped two ranks again. Oh well, hopefully I’ll figure out some sort of clever quant trading strategy and zoom up the ranks.

2022-11-16 16:43:49 Gay Marriage Bill in 2022?

$3166.0 for 3198.238 YES shares (market price 98.69% -> 99.00%)

19.11.22

15:18 - … My goal for the day was to start investigating the Salem Center Manifold stuff to try to figure out how things worked, what the rankings were, and come up with a strategy to advance. Naturally, I … didn’t get to Manifold until after 3pm.

When I got in, I noticed that the Gay Marriage Bill market was down to 95%. The top ranked player, Johnny Ten-Numbers, has been buying it down and started a discussion asking why everyone was so confident, saying that “ The current leaderboard numbers 3, 4, 8, 10 and 12 have pretty much bet their entire fortunes” (the last being me of course). I suppose if it does somehow fail, at least I’ll be in good company! To be honest, I saw everyone rushing in and assumed it would be resolving shortly. One of the commenters (zubbybadger, not ranked) said they think it will pass in the first week of December. Of course if I had known it would take so long to resolve, I wouldn’t have jumped in, just for the sake of having liquidity in the intervening weeks. Oh well.

It’s funny to see Zubby talked about like a nobody at this point, since he ended up winning the entire contest.

Anyway, after seeing that, I figured I should write this journal entry, so I haven’t actually started researching Manifold yet. Not that it will matter too much if there’s nothing I can do until mid-December anyway.

Learning about Manifold

When I first started the contest, I had no idea how Manifold actually worked, but after getting catapulted onto the leaderboard following the midterms, I realized I actually had a chance and should start actually trying, and as alluded to in the above journal entry, the first step was to research how Manifold actually worked.

Previously, I had assumed that the market prices were somehow determined by crossing YES and NO bets. However, a bit of googling revealed that Manifold actually uses an algorithm for automated market making, a concept I had never heard of before. You can find the details online if you want, but the bottom line is that it means that market price changes in response to bets are determined by a simple fixed algorithm, rather than relying on users to make the market and cross orders manually. One consequence of this is that there’s always a little bit of potential profit available even at extremes, such as when the outcome of the market is already certain and it just hasn’t resolved yet.

The other prong of my research was to write a script to scrape the public bet histories and reverse engineer everyone’s portfolios and scores, and thus the leaderboard.

20.11.22

16:07 - … Anyway, yesterday evening, I (finally) got around to the Manifold thing and worked on that for an hour or two. The page for each market shows a complete list of bets, with the player, amount, and approximate probabilities (e.g. “Spencer Henderson bought S$168 of YES from 52% to 56% 8 hours ago”), although it doesn’t show the shares received. I had assumed that I would just have to scrape those pages and then approximate the number of shares received based on the start and end probabilities, which would at least let me estimate the current standings and portfolio of each player.

Fortunately, it didn’t come to that. As it turns out, the page source shows much more detailed data, including the exact amount of shares received for each bet (as well as the exact start and end probabilities, whether it was a limit order and if so how and when it was filled, etc.). Even better, Manifold also has an API to get this data so I didn’t have to scrape it all by hand. After some trial and error, I wrote a Python script to use the api to get the data for each market, and then added up all the bets to get the current holdings of each player and their current total market value.

At least as of yesterday evening when I scraped the data, the current standings are 1st - 8924, 5th - 5334, 10th - 3255 (and me at 3034 in 12th - of course there’s lots of people close behind me as well.) It will be a tall order to triple my money relative to Johnny Ten Numbers, but hopefully I’ll figure out a way to do that.

I also discovered in the process that the market probabilities as well as share amounts and money are arbitrary decimals and it just all gets rounded in the UI, which makes sense and explains a lot. The API also has options to place and cancel bets as well as just fetching data, which would allow things that are impossible through the normal website such as setting a limit order at an arbitrary decimal price, though I doubt it will ever matter much.

Note: The API doesn’t actually let you do this.

My plan for today was to further dig through the data to a) figure out how the trading fees work and b) look at the holdings of the top players and their bet histories to try to understand what strategies they might be using. As usual, I was hoping to get started early, but it is already 4:21pm and I haven’t started yet. Oh well.

21.11.22

06:07 - I spent a while looking through all the markets and the top players’ portfolios, but I still haven’t come up with a plausible strategy yet. I’m now down to 13th, though I’d be in 11th if the Gay Marriage Bill market magically resolved. One notable discovery is that Mike Aniello, then 11th, has most of his money on Republicans to win the Georgia Senate seat and would be instantly catapulted near the top two if that actually happens.

I also spent considerable time trying to reverse engineer the fee formula, looking at the before and after numbers for a couple bets and trying every combination I could think of, but nothing matched up. Eventually, it occurred to me that Manifold is open source and I could just look up the code, which I did. So that was pretty embarrassing. Oh well.

My plan to figure out a good strategy by looking at what the top players were doing was a complete bust, but one nice side effect of the Python script is that, as alluded to above, I could also ask it to calculate what the leaderboard would be under hypothetical scenarios if a market magically immediately resolved a certain way.

The Desktop

To be clear, I didn’t exactly have real time information from the script. I’d been using a Chromebook as my main computer for many years, and had a Linux desktop that I only sometimes booted up on the weekends for the purpose of programming projects like this, and thus all my Salem stuff was on that desktop and only accessible on the weekends. When I work from home, I use the same monitor, keyboard, and mouse, and thought it was a hassle to constantly plug and unplug the various computers and move the monitors around, so I only bothered to fire up my personal desktop on the weekends.

Additionally, the script took a minute or two to fetch updated data from the API, so I only occasionally bothered to do so. So I only checked in on the Salem standings via my script every week or two, but it was still better than not having the information at all, I guess. Initially, the script wasn’t of much use, but I continued tweaking it and adding functionality over the course of the rest of the contest, and I made a lot more use of it later in the contest.

01.12.22

08:11 - I forgot to mention that yesterday, I went to Salem Markets again and noticed a new comment from ussgordoncaptain (current #8) on the gay marriage market explaining that “I wagered it thinking this was a simple resolution hop event not looking hard enough, sadly at this point it’s too hard to sell out”, so exactly what happened to me as well. At least I’m in good company. I’m also back up to #11, but that’s probably just random variations in the market values, since not much happened last week.

December

December was again quiet for me, up until the last week.

The GA Senate Runoff (Dec 6)

The main event of December was the GA Senate runoff election on the 6th. Unfortunately, I had foolishly locked up my money in the Gay Marriage market weeks ago and thus couldn’t actually do anything on Salem other than watch helplessly. But that didn’t stop me from trying anyway:

04.12.22

19:11 - I also spent a while this evening looking into the Salem/Manifold stuff some more. I realized that I am effectively in 12th place rather than 11th, because the current 12th, Asher Gabara, is hot on my heels and has a big bet on Warnock besides. On the other hand, if Walker somehow manages to win (and the gay marriage bill goes through), I’d be in 10th. But of course I wouldn’t hope for a tragedy just for the sake of gaining a few points in a pointless competition.

I also discovered that Andy Martin, a newcomer to the leaderboard (currently 14th) is all in on “China Reaches 100,000 Covid Cases by Winter”, which seems increasingly likely (hence their rise through the ranks).

05.12.22

08:07 - When I looked into Salem last night, it showed one player (Max) with a negative balance, which shouldn’t be possible, thus indicating a likely bug in my code. But it’s probably not too serious, since everything else makes sense, probably just improper handling of open limit orders or something like that.

06.12.22

21:50 - After work (and to be honest, even before, starting around 4pm), I checked in on 538 to watch the election results come in. If the outcome became clear before the markets on Salem adjusted, it might have made sense for me to sell part of my stock in Gay Marriage, even at a loss, to play the GA senate market.

However, Johnny Ten Numbers (the longtime first-ranked player) bought Gay Marriage down to 92% (with just $60), and GA Senate from 15% down to only 6% (with $3000) early on, ruling out any possibility of profit there, unless Walker somehow won out of nowhere and noone got the news before I did. I was especially frustrated to see Johnny betting big on the senate since the profit on that one bet alone would be way bigger than anything I’d get on gay marriage even if/when it passes, and bigger than most wins I could plausibly hope for in the future. Incidentally, there was also bad news on that front, as the House was supposed to vote on the Gay Marriage bill today, but it was delayed for unclear reasons.

It didn’t take long after 5 to decide that there was negligible chance of Walker suddenly winning, and I stopped paying attention to the news and markets.

Some Bankman Fraud (Dec 12)

On December 12th, Sam Bankman-Fried was indicted, leading to huge profits to whoever was fortunate enough to see the news first and bought up the market on Salem. (It looks like Ussgordoncaptain was first, with Johnny and then Josiah Neeley joining in later).

This didn’t affect me, since my money was still locked up, and in any case the whole spike and resolution happened in the space of an hour and I only found out about it well afterwards. However, this was presumably the cause of the huge jump in 8th place on December 12th in the graph above.

Gay Marriage (Dec 13)

On December 13th, the Gay Marriage market finally resolved, thus unlocking my money after nearly a month of forced inaction. However, I didn’t actually have any plans at the time and just left my money in cash for the time being.

Disillusionment (Dec 18)

18.12.22

21:36 - … Later this evening, I checked in on Salem/Manifold again. I’m now down to 13th, but more significantly, the top 5 now all have more than double my money, and Johnny is up to over 12k. I was reluctantly forced to come to the conclusion that I just don’t have any chance and it is best if I just stopped even wasting time thinking about it entirely. It’s especially frustrating because it feels like the kind of thing that I should be good at, with my math and programming skills. I think that maybe if I had been more experienced and had even gotten around to programming a trading bot like I wanted to, I might have had a chance, but I never got around to it and it is obviously too late now. Oh well.

Final Bets (Dec 19)

20.12.22

21:44 - … I spent the rest of the evening on Salem, despite my decision to abandon it just the night before. I decided to go back and divided my money up between the five near-certain markets that will be resolving at year end (e.g. Recognition of Taliban in 2022, Trump indicted of crime in 2022, etc.). I figured that there’s a chance I might decide to get really into it in January and actually write and set up a trading bot, maybe just to see how I’d do out of curiosity or see if I can get back into the top 10 at least even though there’s no prize for that. The year-end markets were already down to 3-4%, but even a 3% return should help slightly reduce the ground I’m constantly losing to the higher ranks until January.

Note: The entry is dated December 20th, but I was writing about what happened the previous day on the 19th:

2022-12-19 20:43:04 Will Donald Trump Be Indicted for a Crime in 2022?

$500 for 519.404 NO shares (market price 4.32% -> 3.91%)

2022-12-19 20:47:31 Over 100,000 Monkeypox Cases in 2022?

$500 for 515.150 NO shares (market price 3.35% -> 3.15%)

2022-12-19 20:48:24 Recognition of the Taliban in 2022?

$100 for 102.165 NO shares (market price 2.56% -> 2.12%)

2022-12-19 20:50:40 New Iran Nuclear Deal in 2022?

$500 for 519.283 NO shares (market price 4.25% -> 3.94%)

2022-12-19 20:53:19 Will Russia Control Kramatorsk on 12/31/22?

$500 for 515.891 NO shares (market price 3.51% -> 3.29%)

2022-12-19 20:55:36 COVID Falls Below 20,000 Cases in 2022?

$500 for 515.633 NO shares (market price 3.46% -> 3.24%)

Limit Orders

In addition to throwing most of my money into risk-free interest rate markets before I left for Christmas vacation on the 21st, I crucially also experimented with limit orders for the first time.

I was aware that the top players were using limit orders, but had no idea how they worked and hadn’t bothered to try them out myself yet. The first thing I discovered is that they don’t lock up your money like I had assumed. I had assumed that when you place a limit order, it also reserves an equivalent amount of your cash in order to ensure that the limit order can be filled when applicable.

However, it turns out that that isn’t the case, and you can place multiple limit orders with the same amount of money, and so I did. I put one limit order at a little above market price for each of the five near-certain markets, and then randomly decided to place a large way-out-of-the-money limit on China COVID as well for fun. Fortunately, fate smiled upon me and I got very lucky with that limit order.

28.12.22

22:01 - When I accidentally checked the Salem markets again this morning, I was surprised to see a balance of -$100. Before I went on vacation, I had 3098, and I put 500 into each of the five near-certain markets that would be resolving at the end of year, and left the remaining 598 as dry powder.

I tried entering a limit order for the first time, putting one down for Trump Indictment at 10% for 598 (it was 4% at the time) to hopefully profit in case someone did a big dumb order pushing the price way up. Then I tried putting in similar limit orders on a couple other markets. I had assumed that putting in a limit order locked up the relevant capital, but apparently not. It let me put in multiple limit orders backed by the same money. For fun, I also put one for 598 at 70% on the China COVID market. It was 39% at the time, and it is riskier and doesn’t resolve until the end of February so I left more of a margin. I didn’t think anyone would ever put in such a huge order to actually hit it, but figured I should do it just for fun.

Anyway, that’s where things stood for a week, but then yesterday, I decided to put another 100 down on Trump Indictment (NO), since the deadline was approaching and I figured I should try to lock in at least 4% while I still could, leaving me with 498 in free cash.

It turns out that not long after that, Dylan Levi King, formerly around 20th place, apparently went crazy and put 2,486 (presumably their entire stack) into YES on China COVID, buying it up to 72%, and thus filling my huge-way-out-of-the-money limit order, a huge lucky break for me.

When I saw that it let you put in multiple limit orders with the same money (and even spend the money afterwards), I had assumed that it would just only fill limit orders up to your available money. However, that is not the case. My entire limit order was filled, bringing my free cash balance down to -100.

Even weirder is that four hours after Dylan Levi King’s initial splurge, they sold everything and went all in on NO instead, bringing it down to just 16%. And then I got a second, more minor lucky break, as they had just happened to decide to buy it back up to 61% again, only ~30 minutes before I happened to check this morning.

Users had already bought it down to 52% when I saw it, but I decided that at that price, it made sense to sell some of my stacks in the Dec 31 markets and get more China shares, even though selling incurs huge losses, and I also had to fill in the 100 deficit first. And thus I put 498 more in, buying down to 39% (it is currently at 27%, but it seems very unlikely at this point, and in any case, I’m pretty much committed to assuming it resolves NO).

Anyway, Dylan’s generous donation very luckily hitting the one limit order I put out catapulted me up to 9th in the rankings, and it might be even higher once the China market resolves at the end of February. So that was extremely fortunate. Another break like that and I’d have a decent shot of the top 5, though it’s hard to expect lightning to strike twice.

January 1-15

Thanks to the lucky break in the China COVID market courtesy of Dylan Levi King, I ended December up in 9th place, and thus when I returned from Christmas vacation in January, I felt like I had a real chance and started participating on Salem far more actively than before.

Initially, I tried to make lightning strike twice, by placing limit orders way above/below market prices in various markets, hoping that a dumb whale would donate money to me like Dylan Levi King happened to do over Christmas in the China COVID market. However, that strategy ended up not working and even backfired in several cases when the markets suddenly shifted for legitimate reasons, so I was forced to abandon that tactic.

Instead, I started checking the Salem website frequently, several times a day in the morning and evening, in hopes of just happening to be the first person to check the website after a massive dumb-money price swing that I could profit off of by trading against.

The other big event of early January was the Q4 GDP >= 4% market. I thought it was massively undervalued, since the Atlanta Fed’s GDPNow website was predicting first 3.9% and later up to 4.1%. It seemed crazy to me that the market price would be as low as 12% when GDPNow was forecasting 4.1% GDP growth, and I bought it up to 25%, and was continually surprised when it failed to spike following the GDPNow updates and in fact went back down.

I found the schedule for GDPNow forecast updates and made a point of checking the website when each update was scheduled, because at the time, I assumed that other people would be checking and trading based on the same website, and thus I could profit by doing it first. However, it seems that hardly anyone else was doing so, as the markets stubbornly kept going back down, and also didn’t seem to react at all in the hours following the GDPNow updates. I guess everyone else had different preferred news sources.

10.01.23

22:24 - I guess I should talk about Salem as well. I’ve been a lot more active in Salem for the last week. Sadly, I actually lost ground as far as “portfolio value” goes in that time, due mainly to getting caught out with a bad limit order.

It started Tuesday morning last week when I saw GDPNow update to 3.9% and bought the Q4 GDP >= 4% market from 9% up to 18%. I got cold feet later, especially after the Thursday update dropped down to 3.8%, but I managed to cash out a little part with a limit at 20%. This morning, the latest update jumped up to 4.1%, and I bought the market up to 25% and left a limit order there (and thus bought more when people pushed it back down). So far, it has been sold back down to 20%. It’s so nerve-wracking, especially since it’s just an “expected value” bet - the actual resolution is very far from certain.

The big hit came yesterday though. Since December, I’d started putting in a lot more limit orders to try to profit in the unlikely event of a wild price move. I put in $444 at 44% on Russia to control Bakhmut at a time when it was in the 20s and there seemed to be no chance of it actually happening, but yesterday, the probability jumped up with the news of Russia’s renewed assault, and my limit order unfortunately got filled. That’s one of the risks of limit orders - there’s always a chance of new information when someone is betting, even if it seems unlikely a-priori. Which is incidentally a reason why I never put any limits on something like “DeSantis to run for President” - conditional on the probability shooting up, it is very likely due to new information.

I put in a corresponding YES limit on Bakhmut at 43% this morning, hoping that people would push it back down slightly and cash me out, but instead, it kept going up. I upped my limit to 46% this afternoon, but the market is now up to 51%. I’m regretting not buying a bit with quick orders, but of course hindsight is 20-20, and it is frustratingly hard to find actual news from Ukraine.

The one semi-bright spot for the time being is the China COVID market. I got really worried yesterday morning when the latest report was 14k cases, uncomfortably close to 100k. During the day, someone bought it up to 62%, but as I was panicking, I didn’t try to buy it back down (people since took it back down to 37%, so at least the others are more confident than me). Today, there was no report at all, and I have no idea what to make of that.

Anyway, playing Manifold is surprisingly nerve-wracking, even though there are no real stakes other than bragging rights, and I only got to the position I am in now by being pretty lucky in the first place. Still, I really want to win.

11.01.23

20:52 - As far as Manifold goes, not much is new, except that three days ago, back when I was panicking about the China market, I put in a YES limit for $340 at 34%, and after the spike later that day, the market has continued falling, and this evening someone pushed it all the way down to 34% and bought out my limit, thus cashing out 1000/2868 of my shares.

I don’t understand why the rest of the market is so confident, and I also don’t understand why the page I was looking at (from the China CDC) hasn’t reported any regular daily reports since the 8th. But I guess my risk in that market is reduced now. Of course, the paradox of these things is that you always feel bad about limit sales, no matter how they happen. When the market finally moves enough to hit your limit, it suddenly feels like they know something and you’re just leaving profit on the table by cashing out. Oh well. On the Bakhmut front, I upped my limit to 52%, but still no takers. On the Q4 GDP, someone pushed the market back up from 20% to 25%. I haven’t put in any new orders, so it doesn’t directly affect me, but it’s nice to have a vote of confidence that at least I’m not the only person who thinks it should be higher.

14.01.23

10:57 - On the Salem front, China COVID jumped back up to 27% (from 21%) overnight, Bakhmut jumped back up to 48% (from 45), and GDP 4+% is down to 15%.

11:19 - I also installed the Twitter app on my phone and created an account and followed @realDonaldTrump so I can get a notification and hopefully buy up the “Donald Trump back on Twitter” market first in the unlikely event that he ever tweets again. I’ve steadfastly refused to create an account on Twitter all these years, even though the UI makes it really annoying to browse without an account, but I figure I should take any edge I can get on Salem. At least I can uninstall it again on March 31st when the market ends.

15.01.23

22:24 - Saturday evening, the China COVID market suddenly jumped to 37%, though the two people responsible are clueless IMO. In fact, one of them is the guy who literally joined the contest just to try to persuade Salem to resolve the market YES (after finding out about it due to a linked market on regular Manifold and getting angry about it) and has been commenting endlessly on that topic ever since. However, I declined to take advantage because I was down to only $500 in free cash and wanted to preserve it in case something else comes up, and thus the profit opportunity fell to others (it fell back to 29% this morning). It’s a further layer of irony, as I FOMO’d into China at low prices only to regret it after seeing the US market, and then I regretted plowing so much into the US market because I didn’t have the spare cash left to take advantage when fools mispriced the China market. Oh well.

Speaking of Manifold, this evening I got on the computer and ran the scripts again to see what would happen if I won the GDP 4% market or not. If it resolved YES today, I would be in 6th place, and just a hair’s breadth from fifth. If it resolved NO on the other hand, I’d still be in 9th, but just barely above 10th. It’s a little nerve wracking to have so much riding on what is essentially a coin flip even under the most optimistic scenarios. But to be fair, I only got as far as I did in the first place with an incredible amount of luck, and even if I lose, I’ll still be on the leaderboard at least. It seems like a decent gamble for something that will near-guarantee me top 5 if it pays off.

I woke up to an email from Twitter this morning, with a digest containing a bunch of rightwing tweets from random accounts I didn’t follow. When I set up Twitter, I followed Donald Trump and also followed Paul Krugman as a test to make sure the notifications were actually working. I was disappointed to discover that I did not get any sort of notification on my phone or any notification when Krugman tweeted yesterday, and did somehow get an email with a digest of people I’m not even following. You had one job, Twitter!

Fortunately, after looking around in settings more, I discovered that I had accidentally turned on Do Not Disturb on my phone. I turned it off and also set Twitter notifications to bypass DnD for good measure. I also of course went through the Twitter settings menus and unchecked everything I could that wasn’t specifically “tweets from people you follow”. Sadly, there’s no settings option for “spam from random people you aren’t following”. I later got a notification for a (re)tweet by Krugman, so I assume it works now, and unfollowed him.

January 16-31

For the first half of January, up until around the 18th, things were looking pretty good for me as my frenetic betting had slowly increased my score. Unfortunately, the second half of the month was just one setback after another, followed by one last blow at the end of the month so significant that I was convinced that I’d been knocked out of the contest for good.

China GDP

The first setback was a minor loss from my limit orders in the China GDP market.

16.01.23

22:04 - Well today was a chaotic day on Salem, though it fortunately mostly worked out for me in the end. There are two thinly traded markets for China 2022 GDP 4% and World GDP 3% respectively, and I’d of course frequently seen them and eyed them as a potential new source of profit, but I wasn’t able to turn up any information in a cursory search, even basic stuff like when the numbers are expected to be reported (but it sounded like this would happen in June).

Anyway, five days ago, I put a small $50 limit for YES at 50% (and another at 21%) on the China market, which was at 64% at the time and had recently been in the 70s. With no information and expected resolution not until June, I didn’t want to risk much, but I figured I should put some way out-of-the-money limits down to try to catch fat finger/whales.

The China GDP market was at 61% last night, and thus I was surprised when I checked again this morning and saw it down to 48% (and thus my first limit was hit). It continued falling through the day, and when I checked again tonight it was all the way down to 20%. Most of the selling over the last day was due to one person, Iraklis Tsatsoulis, who posted a comment three hours ago linking to a news story that China just reported a 2022 GDP of 3%.

I quickly sold my shares (for $58, thus a total loss of $42) and then decided to put $300 more in buying NOs. I got 355 NO shares, so assuming it resolves no and you ignore the time value (i.e. opportunity cost) of money, I’ll actually profit slightly overall. It’s a big risk putting in half my bankroll, but I’m hoping that it will resolve imminently, given the report of an official GDP release. And either way, I still have $333 in free cash left now.

I am kind of groaning that I didn’t do enough research to actually figure anything out about the market and catch the fall ahead of time myself, but at least I’m in good company. In fact, Johnny put 375 into YES on the way down, and the Kalshi market was completely taken by surprise as well (Iraklis suggests that the Salem market was completely out of whack due to people trusting Kalshi too much - of course I don’t look at prediction markets myself except occasionally when people link them in the comments on Salem, but I relied on it by proxy by assuming the current market was sane. On the other hand, it makes me a little more optimistic that Kalshi might be wrong about the US Q4 GDP as well. The Kalshi market only goes up to 3.5%, but when I looked recently it had a forecast of only 15% for 3.5 (now up to 30%). I assume the reason the Q4 GDP market has been so much lower than I thought reasonable was because other Salem members were relying on Kalshi. It makes no sense otherwise for the market to go as low as 12% (now back up to 15%) when GDPNow is forecasting 4.1% GDP.

But that wasn’t the only excitement on Salem today either. This morning, I finally gave up on cashing out my Bakhmut position at the 43% limit with the market languishing at just under 48, and so I put in a new limit to cash out at 48%. I was really surprised when I checked again in the afternoon and saw that it was down to 42% and that instead of getting (most of) my money back, I suddenly had an equal number of YES shares. Presumably, I forgot to cancel the 43% limit. Oops. I put in a NO limit at 48 to cash out just in case, and tonight someone bought it back up to 48% and cashed me out, so all’s well that ends well, I guess.

I also noticed this afternoon that Johnny had almost bought up the rest of the 25% limit on the US COVID market a day after I put in the 1050, so I felt a lot better about my decision to commit so much then. I worried that it was an opportunity that wouldn’t last forever and I was vindicated much faster than expected. Tonight I bought the last $36 of the limit, and discovered that the other limits were all gone too. Up to this afternoon, the same person who put the giant limit at 25% also had limits at 24%, 22%, and 20%, but they suddenly canceled all of them.

Q4 GDP

The next big setback was in the Q4 GDP 4% market, where I had a larger bet, thanks to the odds seemingly being so good. On the 18th however, the bear consensus was justified when the GDPNow forecast suddenly dropped from 4.1% to 3.5%.

There were also some worries in the Trump Twitter and China COVID markets that I’d forgotten about because they were ultimately insignificant. It’s interesting looking back at my journal entries and seeing what I wrote about at the time vs what I remember now.

18.01.23

07:32 - Well, the morning didn’t start with good news on the Salem front. Patrick commented, pointing out that the Chinese CDC has now officially released an update mentioning 1.27 million cases of COVID in hospitals. It appears to be a snapshot rather than a report of new cases, but it is still concerning, since there is a risk John Hopkins decides to average those into the case numbers somehow anyway.

Also, I noticed the Donald Trump Twitter market spiking up. I quickly checked that he hadn’t actually tweeted, and then decided to throw $200 in (69->63%). Then I googled it to see what the fuss was about and found a new article that says Trump is planning to tweet again and has been talking about it for weeks. I wish I’d done them in the reverse order. Of course, there’s still a chance that he doesn’t tweet before April, but I wouldn’t have taken those odds if I’d known. I really need to learn how to stop FOMOing into things (or the reverse in this case, I guess). Also, the China GDP market is back up to 11% (other people cashing out).

08:17 - I spent the morning reading the latest Magic spoilers on Reddit to distract myself, and when I checked back the Trump Twitter market was down to 61% and I had managed to partially cash out with my 62% limit, so that was nice. Of course, the real risks are the Q4 GDP and China Covid markets, since those are the ones I have large positions in (well, I also have a huge position in the US Covid market, but I’m not worried about that one). But I can’t really do anything except just wait and hope for the best.

08:36 - Johnny just left a comment saying that he thinks the new CDC report is actually evidence in favor of NO, because it is the first report that doesn’t explicitly list new cases at all, consistent with China’s plan to stop reporting those. I sure hope he’s right. He also pointed out that OWID has now been updated with a string of 0s for the last few days (previously it just stopped at Jan 10th). But of course it’s theoretically possible that they decide to put that 1.27 million in somehow anyway, even though it is a completely different type of data.

11:10 - I couldn’t get Salem out of my mind and just checked again, and then discovered more bad news - this morning’s GDPNow update is down to only 3.5%. I’m still planning to hold it just in case, but I guess I need to resign myself to the fact that I’m probably effectively in 10th now and top 5 is a longshot again. Hopefully, this means I can stop worrying about it as much now, but I doubt it will actually happen that way.

21:52 - As far as Salem goes, the silver lining is that checking at 11am at least let me cancel the limit orders I had on Q4 GDP at 12 and 10% before they were hit, and thus I avoided throwing another $90 into the fire. On the other hand, I discovered this evening that a $50 limit at YES 45% for Donald Trump Indicted that I placed 11 days ago was now filled (it was 62% at the time I placed the limit.) I went through every single market on Salem and canceled all the random old limit orders I had placed in early January.

I had been hoping to replicate my stroke of luck with Dylan Levi King in the China COVID market in late December, but instead, the majority of the limits I placed ended up being harmful when they were hit. Oh well. At least I can be glad that I’m not KDM, who had a $250 order at 50% filled for Donald Trump Indictment placed 12 days ago.

Note: I sold the Trump Indictment shares on January 30th at 52.46% for a profit of $8.29, so that one ended up working out for me at least.

I also finally gave in and quick-sold the China GDP (11->12%) and put most of the money into the “new general state mask mandate by end of Feb” market (18%). I definitely regret not quick selling at 7% last night though. It’s so hard to predict when other players will buy or sell, and how much.

Anyway, on to real, non-Salem news. I’ve been spending way too much time and effort on that lately anyway, though it is hard to cut back. …

Biden approval

The next hammer to drop was in the Biden Approval market. I’d assumed that it was practically a sure thing, since there were only weeks left, and his approval rating had a large margin above 42%. However, the approval rating suddenly dropped unbelievably quickly, so fast that even the articles on the 538 website couldn’t keep up with the news.

I ended up refreshing the 538 poll tracker frequently throughout the day, hoping to be the first person to trade off any movements in the polling average. However, this ended up being counterproductive, as I still somehow managed to lose money on every trade.

The most ironic part is that the market ended up resolving YES after all, but it didn’t help me since I sold out near the bottom. I think Josiah, who was heavy on YES but didn’t sell out, did better. But all that was still a week and a half in the future, and with a lot more bad news to come.

20.01.23

21:52 - I’ve still been checking Salem several times a day, even though I’ve largely just been a passive bystander recently. Today was pretty dramatic though, with the sudden decline of Biden’s fortunes in the “Biden Approval 42% on Feb 1st” market, which peaked at 92% two days ago and was at 88% just a day ago.

When I checked around 11 this morning, it was already down to 74%, and Biden’s approval rating on 538’s average (which the market uses for resolution) was down to 42.9%, from a recent peak of 44.1%. Fortunately, though I’d thought it was nearly a sure thing, I hadn’t put much in yet, just 75 at 86%, 50 at 87, and 100 at 79% over the last couple weeks, all via limit orders.

Personally, I thought there is an obvious tendency in politics to overhype every little scandal and figured that the classified document thing wouldn’t hurt Biden much or that he would probably bounce back by February if it did. When I checked around 11, I was amazed how rapidly the price had fallen and figured people were getting ahead of themselves. I initially put a limit at 70-something, but then on second thought canceled it a minute later and just put a small limit at 61% for only $24, due to liquidity issues plus uncertainty over how much the polls would drop. I figured that the current market drop would naturally bounce back as people fought the overcorrection and it would never even come close to my limit.

I checked again around 4pm and was shocked to see it down to 56%, and even more shocked when I checked 538 and saw the polling average down to only 42.2%. I never thought it could move so fast - it looks like two polls were added this afternoon with Biden at only 38%!

Anyway, the good news is that I only had a couple hundred in the market, and not quite bought at the peak, so my losses are a lot lower than they could have been. I checked the leaderboard this afternoon to see if I had fallen to 10th yet, and was surprised to see myself in 8th instead. Josiah Neeley, who has long been sitting just above me at 8th, had suddenly fallen to 10th. Based on the bet history, it looks like he put a lot of money into Biden approval, explaining the sudden drop. As much as I’ve had a lot of losses in all my trading these last few weeks, at least I can be glad that I’m not him (or Connor, who fell from 3rd to 6th).

ussgordoncaptain (currently 7th) also put a bunch in, but not enough to drop a rank, apparently. Meanwhile, zubbybadger (previously 7th, IIRC) has suddenly shot up to 3rd. He was the first person to start selling Biden approval last night and sold a lot of it at high prices. Later, Johnny came in and also sold a lot and presumably claimed a lot of profit as usual as well, but I’ve given up worrying about him, since he is so far ahead and so active that there’s no stopping him, and my goal was just top five anyway, so profits he claims at least aren’t going to the other top players.

When I checked again just now, Biden approval was down to 49% and Josiah was all the way down to 12th. It wasn’t just the Biden thing though - it looks like this evening, Josiah also suddenly sold a large amount of Trump Back On Twitter and bought a large amount of Russia Bakhmut, which of course not only incurs fees and massive slippage, but traders also pushed each market back up/down a few % from the peak after his trades, further eroding his current market value (but of course, it could yet pay off for him if he managed to guess right on the outcomes.) This incidentally also cashed out my remaining Trump Twitter No shares with a limit at 63%. I set the limits aggressively enough that I probably made minimal profit, but what really matters is that that little chunk of money is back out of the market again.

As alluded to previously, I was desperately short of uninvested cash in late January, so getting cashed out was very welcome.

Anyway, I haven’t been affected much beyond watching my positions continue to rack up minor losses, but watching people shoot up, first with Iraklis on China GDP and then with zubby on Biden, I can’t help but get jealous and wonder why it wasn’t me who was able to capitalize on those rare breaks. Of course, there are a lot of players and only a few can get lucky like that, and people’s luck can easily change (much like I got a big lucky break when Dylan sent me cheap China COVID shares last month and then I had a bunch of smaller bets go bad last week.) In particular, Iraklis is already back down to 17th place. I’ve noticed him doing some questionable trades, rushing into markets at low prices and panicking back out when they go up (like China COVID), which is presumably what eroded his standings.

Incidentally, a major silver lining is that if Trump actually does return to Twitter, as now seems plausible, I’ll have a decent chance of being the one to ride the rocket thanks to the app notification. Not a sure thing of course, since others could have easily done the same thing, and the market in aggregate is usually way faster and more knowledgeable than me, hence how I kept getting caught out earlier when people were trading on stories or developments I hadn’t heard of. But it is a chance at least, and Josiah helpfully pushed up the potential profit by selling.

Anyway, that’s way too much discursion on something that is meaningless in the big picture, and where I have only a small chance of winning anyway. But oh well. Now for the regularly scheduled journal entry: …

21.01.23

21:42 - I checked Salem a lot less often than usual, and instead have just been refreshing the 538 Biden approval page every couple hours, which is much faster and accomplishes almost the same thing. However, the 538 average hasn’t been updated since those two polls Friday afternoon that dropped it to 42.2. Salem has also been pretty quiet, with just one minor event of note.

I checked Salem a little before 2 and just happened to notice that only 17 minutes before, zubbybadger had suddenly sold “Biden Cabinet Official Out by Summer?” up from 55% to 69%. At first I thought it was a sudden news break and checked, but only saw a fresh story saying that the Chief of Staff (which is not one of the positions covered by the resolution criteria) was departing. I thought maybe zubby just wanted to free up money for another market, but checked around the other active markets and didn’t see any new bets and after a little while, just forgot about it again.

The lucky timing would have made it a lucky break that I happened to be the first to notice the swing, except there was no actual news development to capitalize on. And of course, I didn’t want to push the market back down because a NO won’t resolve until June. I was puzzled and thought maybe zubby was confused and didn’t read the resolution criteria carefully, but if they really thought resolution was imminent, they should have put everything they had into it.

In an even more remarkable coincidence, I checked Salem again just before writing this, and saw a new comment posted by zubby literally seconds before (9:41pm), explaining their trade, saying “NYT story had Walsh and Vilsack in the mix for Chief of Staff. I didn’t want to be holding the bag.” So that’s one mystery resolved.

The Paradox

I checked my script again and discovered a counterintuitive phenomenon I dubbed “the Paradox”. I was currently in 8th place, but would end up in 9th place no matter how the markets resolved.

22.01.23

16:43 - No real action on Salem since Friday. This afternoon, I fired up the desktop and checked what the standings would be under a few hypotheticals. Assuming GDP 4% resolves NO, I’d still be in 8th place, but only barely above 9-11th, and 5th would be 1.60x me. I also calculated the rankings under all four possibilities for the GDP 1% and Biden Approval markets (assuming GDP 4% is NO as well). Paradoxically, in all four cases, I would drop to 9th place, even though I’m 8th before they resolve. Of course, which person takes my spot at 8th depends on what exactly happens - Josiah if Biden hits 42% and Krum-Dawg Millionaire if he doesn’t. However, my gap from the top 5 varies based on the scenario, from 1.68x if both resolve NO, to only 1.42x if they both resolve YES. It’s a bit frustrating that all my math and programming skills and the script and so on haven’t actually helped me find a winning strategy at all. It just lets me see in more detail just how badly I’m failing or not.

The final week

The last week of the month brought a steady stream of more bad news on the Biden Approval and GDP >4% fronts, with the latter resulting in my largest single loss of the entire contest.

23.01.23